Cobalt Supply Shock: DRC Tightens Grip on Global Market

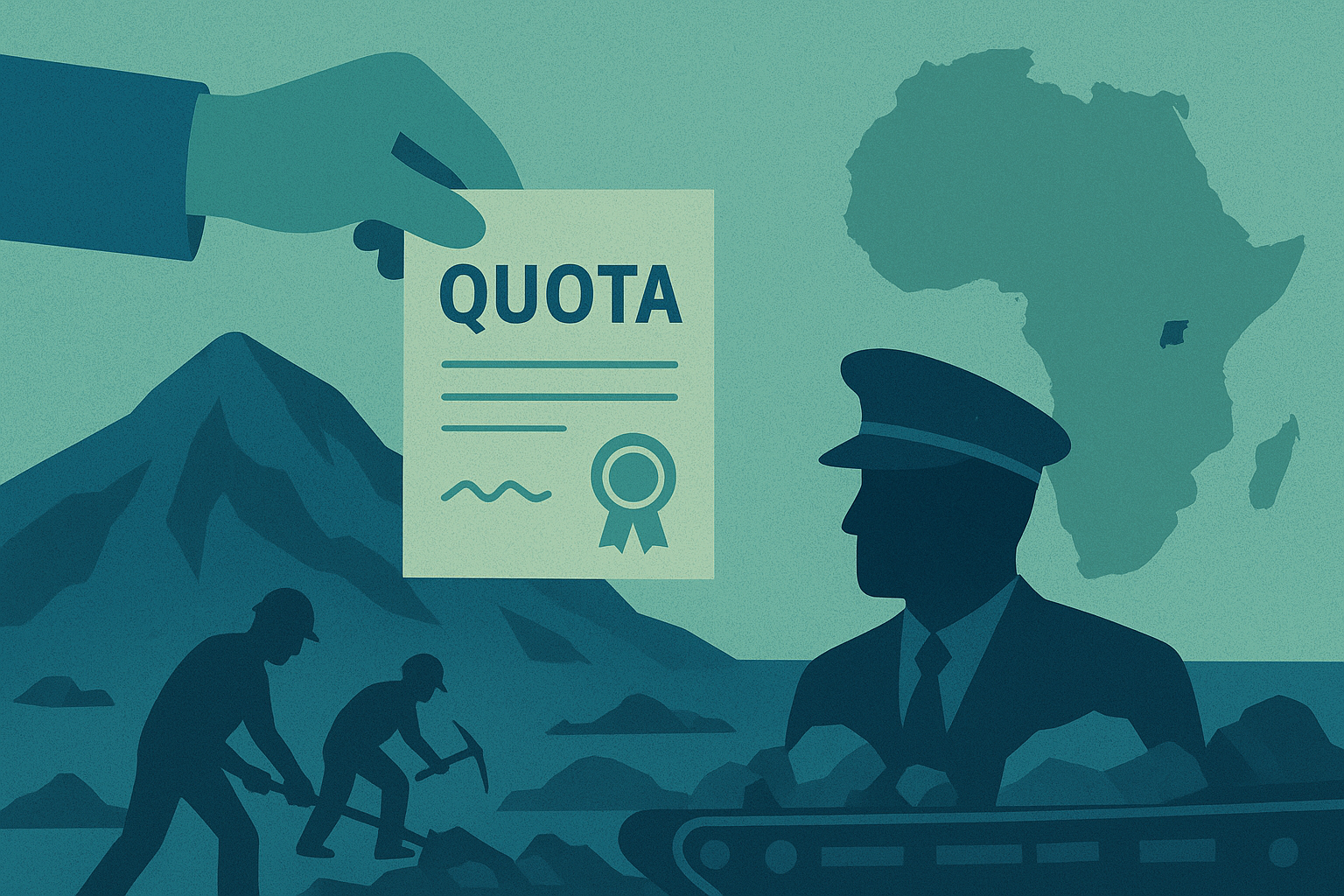

The global cobalt market—already under strain from rising battery demand and supply bottlenecks—was jolted this week as the Democratic Republic of the Congo (DRC) announced a sweeping new enforcement mechanism on its cobalt export quotas. President Félix Tshisekedi confirmed that exporters violating the new quota regime will face permanent bans, replacing the earlier temporary export suspension measures that caused widespread disruption earlier in 2025.

The DRC accounts for roughly 70% of global cobalt production, and this decision signals a major shift in how the country intends to control exports, pricing, and foreign participation in one of the world’s most critical energy metals.

Strategic Shift: From Blanket Bans to Targeted Quotas

According to Reuters, the DRC’s new quota system establishes fixed export caps for the remainder of 2025, with annual production and export limits through 2027. The goal, according to government statements, is to “stabilize revenues, enforce compliance, and prioritize domestic beneficiation.”

This move follows months of policy volatility—earlier this year, blanket bans on unprocessed cobalt shipments disrupted global supply chains and forced producers to halt operations. The new system represents a more nuanced, yet still restrictive, approach: compliant operators will receive annual export allowances, while violators risk being permanently blacklisted.

Analysts from CRU Group note that “the DRC’s shift to a quota-based regime introduces greater administrative control, but also amplifies the political risk profile for international producers operating in the region.”

Why This Matters for Investors

The DRC’s decision has immediate implications for cobalt pricing, project valuations, and supply chain security across the EV and battery storage sectors.

- Supply Risk Premiums Rising:

The cobalt market has remained relatively stable around $16–18 per pound in recent months, but traders now anticipate renewed volatility. With several exporters likely to lose access to the market, near-term shortages could push prices higher. - Policy Unpredictability as a Deterrent:

While the quota system adds structure, the threat of permanent bans injects regulatory uncertainty. Mining companies—particularly Chinese joint ventures, which dominate DRC refining capacity—may seek to hedge exposure or shift focus to projects in Indonesia, Australia, or Morocco. - Downstream Impacts:

For EV battery manufacturers and automakers, this policy shift could tighten the availability of ethically sourced cobalt, pressuring margins and prompting further investment into nickel-rich or cobalt-free chemistries. Companies like Tesla, CATL, and Panasonic have already accelerated diversification into lithium iron phosphate (LFP) and high-nickel cathodes to mitigate such risks.

Analyst Perspective: A Play for Resource Sovereignty

Industry analysts see this not just as a supply policy, but as part of a broader push for resource sovereignty. The DRC has repeatedly called for increased local refining and value addition, echoing similar moves by Indonesia’s government in the nickel sector.

According to Bloomberg Intelligence, “Congo’s quota policy aligns with a global pattern of resource nationalism. While it supports domestic revenues, it risks deterring foreign investment and destabilizing midstream supply networks.”

For investors, this creates a double-edged dynamic: potential upside for non-DRC producers as prices rise, but elevated risk for firms with heavy DRC exposure.

Future Trends to Watch

- Quota Allocations:

Monitoring which companies secure favorable quota allotments will be key to identifying winners and losers. Firms with established relationships with Kinshasa may be better positioned. - Regional Diversification:

Expect increased exploration and capital inflows into alternative cobalt sources, including Canada, Australia, and Zambia. - Battery Chemistry Evolution:

The ongoing supply risk could accelerate adoption of cobalt-light or cobalt-free battery designs—an area where firms like BYD and CATL are already advancing. - Political & ESG Oversight:

Global investors will likely demand stronger transparency in supply chains and heightened due diligence on cobalt sourcing practices.

Key Investment Insight

For investors, the DRC’s quota regime underscores a pivotal shift: cobalt is no longer a simple commodity trade—it’s a geopolitical instrument. Rising political risk may buoy short-term prices but complicate long-term capital allocation.

Watch for producers with low DRC exposure or diversified portfolios (like Glencore, Sherritt International, and Jervois Global) to attract renewed investor attention as supply tightens.

Global cobalt markets are entering a new phase of controlled scarcity, and policy volatility in the DRC will continue to define risk premiums for years to come.

Stay informed with the latest metals and mining developments at explorationstocks.com — your trusted source for investor-focused resource news and analysis.