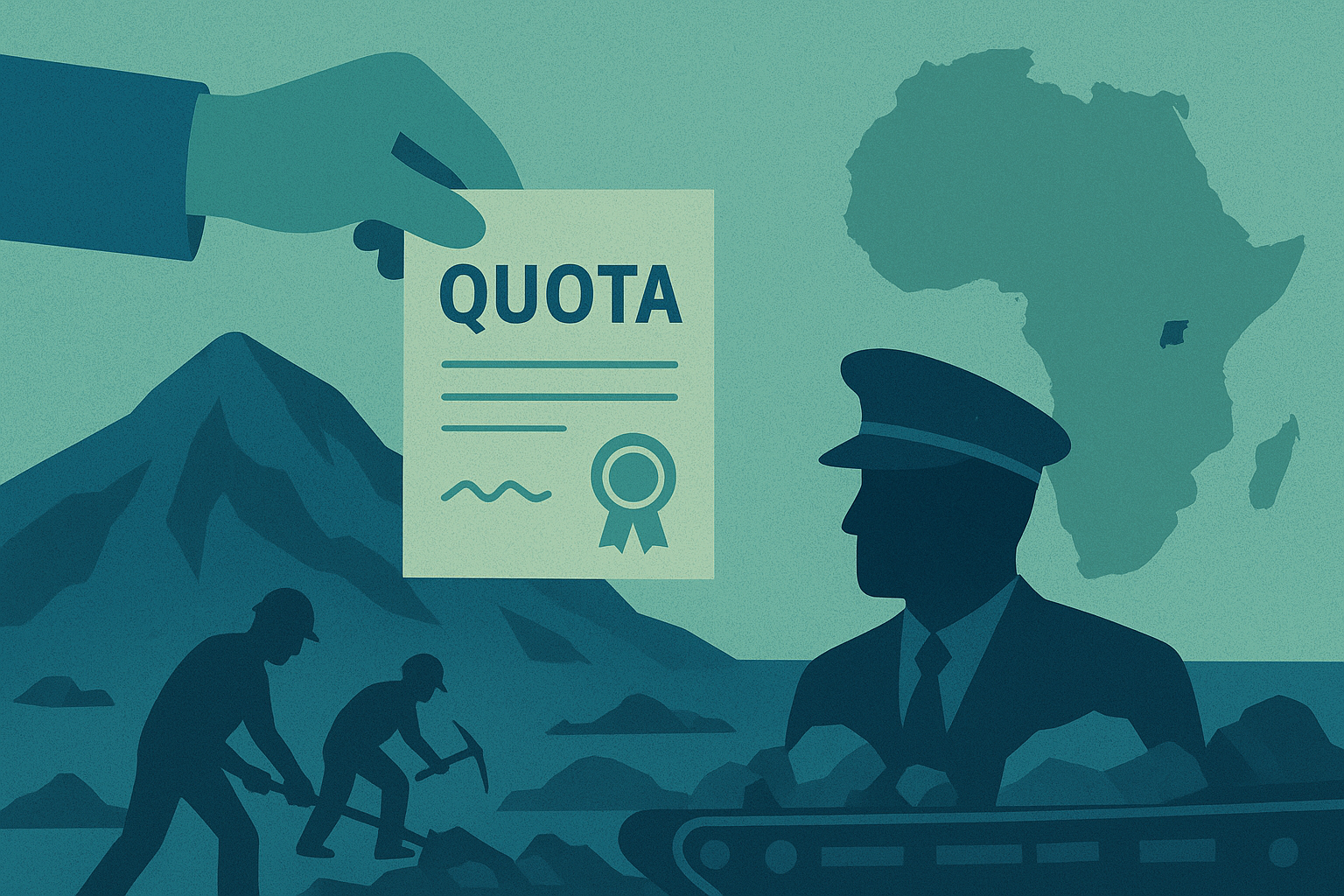

Global markets are on edge as the Democratic Republic of Congo (DRC), which supplies over 70% of the world’s cobalt, prepares to overhaul its export system. On October 16, 2025, the country will end its controversial cobalt export ban and introduce quotas that cap outbound shipments well below historical levels. With cobalt being indispensable for electric vehicle batteries and defense technologies, this move could reshape supply chains and commodity pricing across 2026 and beyond.

Why This Matters for Investors

The DRC’s quota system sets annual cobalt export limits of ~96,600 tonnes for 2026–2027, significantly lower than the nearly 130,000 tonnes exported in 2024, according to data cited by Reuters. For the remainder of 2025, only 18,125 tonnes will be allowed. This effectively removes tens of thousands of tonnes from the global supply pipeline—an amount large enough to swing market balances.

As the clean energy transition accelerates, cobalt remains a vital input for nickel-cobalt-manganese (NCM) battery chemistries used in electric vehicles, grid storage, and advanced electronics. Even though automakers are experimenting with cobalt-free chemistries, such as lithium iron phosphate (LFP), cobalt demand remains structurally strong, particularly in high-performance batteries.

For investors, this policy shift signals a potential tightening in the cobalt market—creating both opportunities and risks depending on exposure.

Policy Shift Signals Geopolitical Risk Premium

The DRC’s government stated that quotas are intended to bring “long-term sustainability and value creation” to its mining sector. However, analysts warn that the policy may add a geopolitical risk premium to cobalt pricing.

- Winners: Producers with diversified supply chains outside the DRC—such as projects in Australia or Canada—could benefit from investor interest as customers seek alternative sources. Major firms like Glencore and China Molybdenum Co. with established positions in the DRC could also benefit if they secure favorable quota allocations.

- Losers: Battery makers and downstream tech companies reliant on consistent cobalt feedstock may face higher procurement costs. Automakers already under pressure to reduce input costs could be forced into long-term supply agreements at higher prices.

According to BloombergNEF, cobalt demand for batteries is projected to rise 30% between 2025 and 2030, even under conservative EV adoption scenarios. With quotas in play, a demand-supply crunch may arrive sooner than expected.

Future Trends to Watch

Quota Allocations: A critical unknown is how quotas will be distributed—whether based on historical exporters, new entrants, or strategic partnerships. This could significantly affect which producers thrive.

Implementation Risks: The DRC has historically struggled with policy enforcement. Illegal artisanal mining and smuggling could undermine the quota system, creating uncertainty for global markets.

Supply Chain Response: Companies may accelerate investments in cobalt recycling and alternative chemistries. Watch for announcements from Tesla, CATL, and European automakers regarding supply diversification strategies.

Price Volatility: If enforcement is strict, cobalt prices could spike in 2026. However, weak global EV demand or oversupply from alternative regions could dampen the effect.

Key Investment Insight

The shift from a blanket ban to quotas adds predictability but also scarcity to the cobalt market. Investors should monitor:

- Producers with non-DRC cobalt exposure (Australia, Canada, Indonesia) for upside potential.

- Major DRC operators to see if they secure favorable quota allocations.

- Battery manufacturers as they adapt sourcing strategies—potentially creating entry points in the EV supply chain.

For commodity-focused portfolios, cobalt exposure may become a hedge against supply shocks and policy risk.

Global demand for critical minerals is only increasing, and the DRC’s quota system highlights just how geopolitically sensitive these markets have become. For investors looking to navigate this shifting landscape, staying ahead of policy changes and supply chain adaptations will be key.

Stay with explorationstocks.com for daily insights into critical minerals, metals markets, and the companies shaping the future of energy and technology.