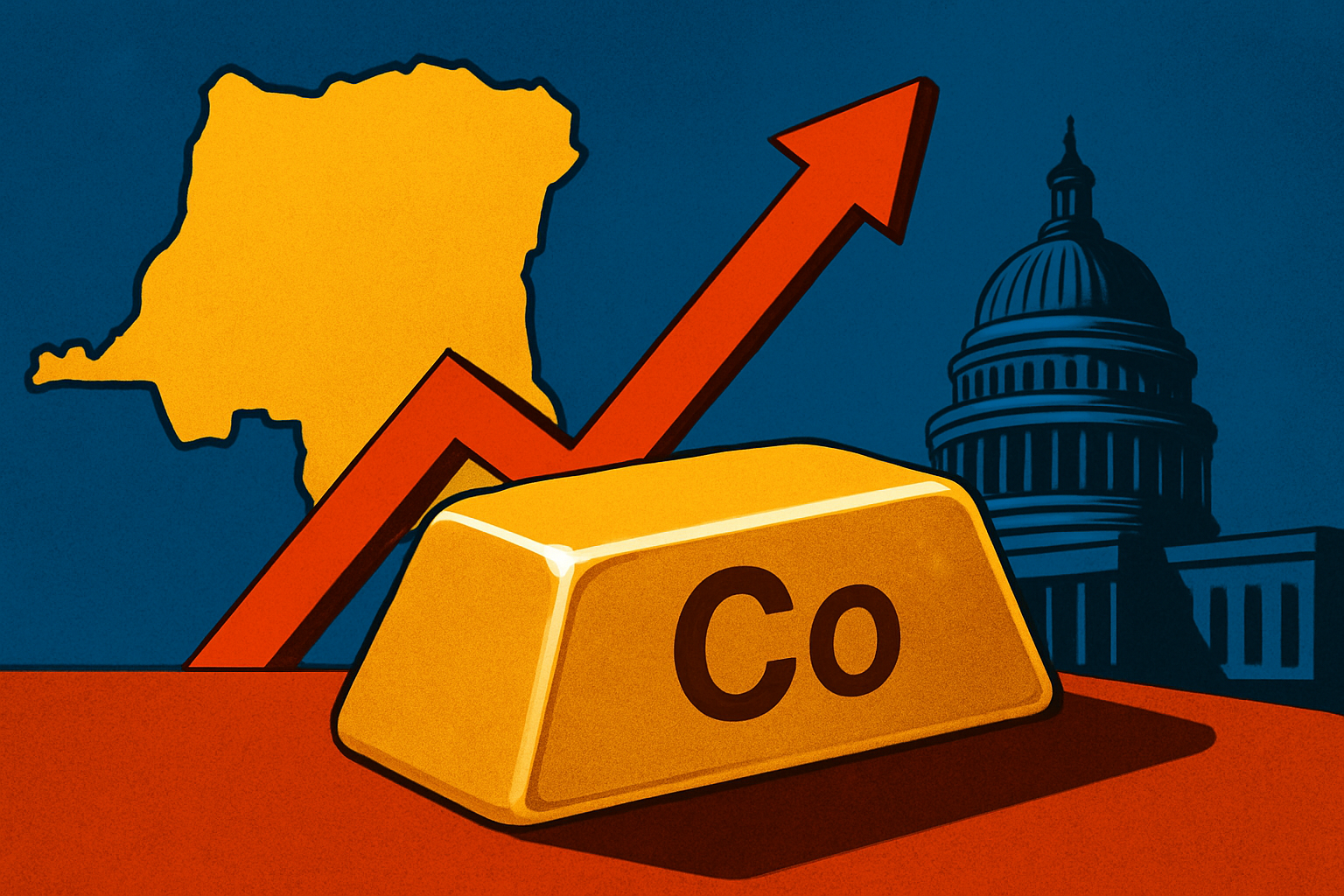

Cobalt markets are flashing red as Chinese refiners scramble to adapt to fresh export restrictions from the Democratic Republic of Congo (DRC). The world’s largest cobalt producer has tightened quotas on cobalt hydroxide, the critical feedstock for electric vehicle (EV) batteries, sending shockwaves through supply chains and triggering a rally in cobalt metal and sulfate prices. In response, Chinese refiners are pivoting to dissolve cobalt metal into sulfate—a workaround that underscores just how fragile the global cobalt market has become.

Cobalt Market on Edge

According to Fastmarkets, Chinese refiners have stepped up purchases of cobalt metal to dissolve into sulfate as an alternative to scarce hydroxide feedstock. The move is driving cobalt metal prices sharply higher, with sulfate values following suit as refiners race to secure raw materials. S&P Global Commodity Insights adds that the transition is not only technically complex but also more capital intensive, raising operational costs for processors already navigating thin margins.

The DRC, which accounts for more than 70% of global cobalt supply, has become an increasingly unpredictable source. Export quotas announced in late Q3 2025 are designed to capture more refining value domestically, aligning with a broader push by resource-rich nations to tighten control over strategic minerals. For global buyers, however, the policy has added an extra layer of volatility to an already stressed supply chain.

Why This Matters for Investors

The shift from hydroxide to metal dissolution highlights a structurally tighter market that could reverberate across the energy-transition value chain. For investors, several implications are worth noting:

- Higher Refining Costs: Dissolving metal into sulfate is more expensive than using hydroxide, meaning refiners face margin compression unless prices rise further.

- Tighter Spot Markets: Increased demand for cobalt metal will reduce availability, fueling price spikes across related cobalt products.

- Supply Chain Fragmentation: Policies in the DRC and other producer nations are pushing buyers to diversify sourcing, potentially creating opportunities for juniors and mid-tier miners in alternative jurisdictions.

As Reuters reports, traders and investors are already bracing for supply deficits heading into 2026, with some analysts forecasting sustained price strength if hydroxide shortages persist.

Future Trends to Watch

1. Policy Risks in Producer Nations: The DRC’s latest move mirrors trends seen in Indonesia’s nickel sector, where export bans reshaped global flows. More resource nationalism could follow, increasing geopolitical risk premiums.

2. Refiners’ Adaptation Curve: While Chinese refiners are proving nimble, scaling metal dissolution at industrial levels will take time and capex. Their ability—or inability—to maintain output will be closely tied to price volatility.

3. EV Supply Chain Dynamics: Automakers, increasingly sensitive to supply disruptions, may accelerate efforts to secure offtake agreements directly with miners. This trend could provide near-term upside for integrated miners with refinery exposure.

4. Inventory Drawdowns: LME and Shanghai Futures Exchange data suggest declining visible cobalt inventories. If this trend continues, traders may anticipate further squeezes, magnifying volatility in both physical and financial markets.

Key Investment Insight

For investors, the pivot toward metal dissolution is less about short-term technical adjustments and more about what it signals: the cobalt market is entering a structurally constrained phase. Companies integrated across the value chain—from mining operations in stable jurisdictions to refining capacity—are positioned to capture upside as supply tightens. Meanwhile, exploration-stage players with promising cobalt assets could benefit from renewed strategic interest as buyers look beyond the DRC.

Positioning early in well-managed cobalt miners and diversified battery-metal producers could offer attractive risk-adjusted returns. At the same time, investors should remain mindful of policy-driven volatility and build exposure through diversified instruments such as battery metals ETFs to mitigate single-commodity risk.

Conclusion

The cobalt market is at a turning point. With the DRC reshaping supply dynamics and Chinese refiners adapting through higher-cost processing, the ripple effects are set to reshape both pricing and investment flows. For investors, this is more than just a short-term supply hiccup—it’s a sign that strategic minerals like cobalt are entering a new era of constrained supply, higher costs, and geopolitical friction.

Stay ahead of fast-moving developments in global commodities with explorationstocks.com—your trusted source for actionable investor news and market insights.