U.S. Eyes Equity Stakes in Australian Critical Minerals Projects to Secure Supply Chains

The race to secure critical minerals is intensifying. With geopolitical risks reshaping global trade flows, the U.S. government is stepping up its strategy: directly offering to take equity stakes in Australian critical mineral projects. This move is designed to diversify supply chains, reduce reliance on China, and position the U.S. as a key player in […]

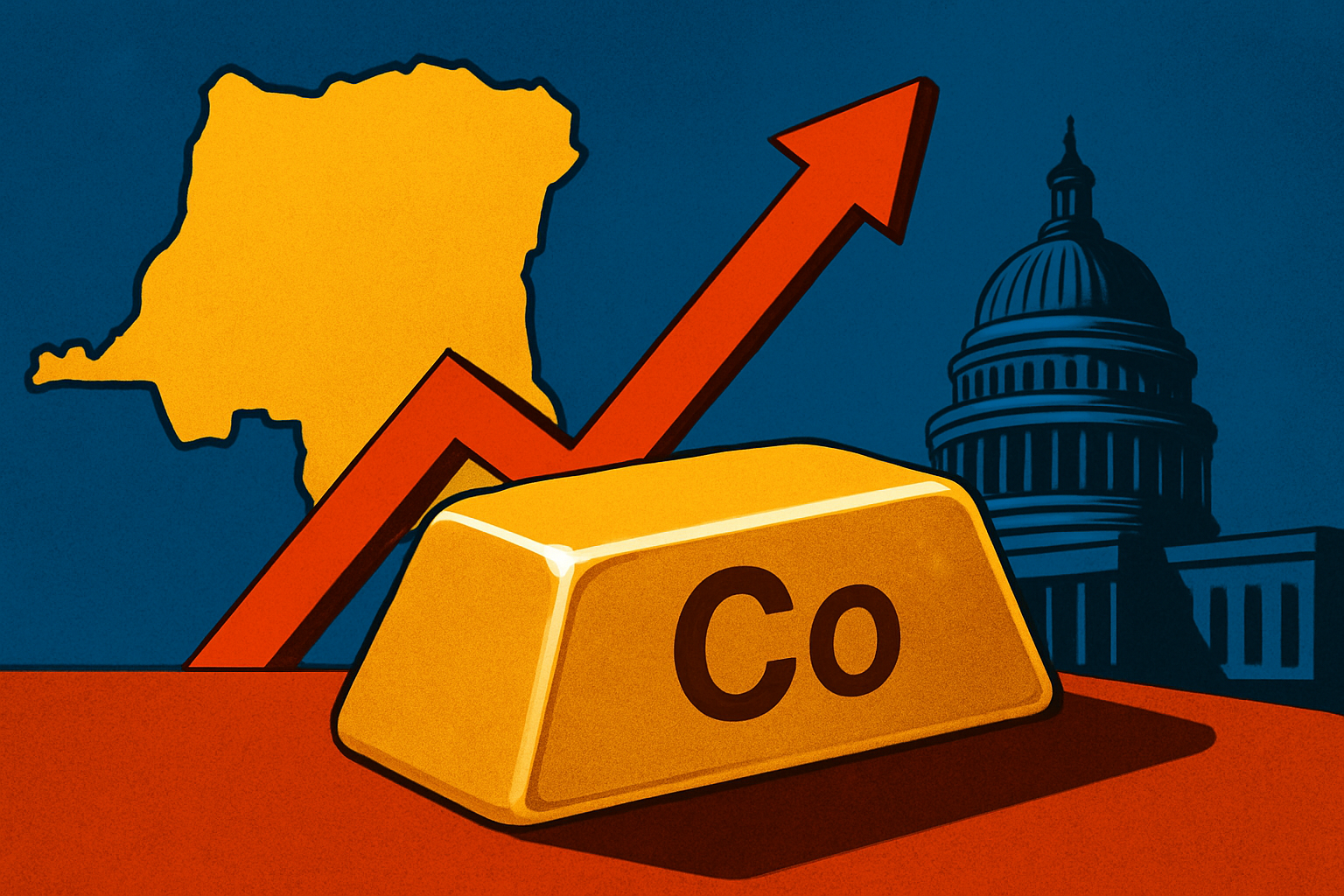

Chinese Refiners Pivot to Metal Dissolution as DRC Quotas Squeeze Hydroxide Supply

Cobalt markets are flashing red as Chinese refiners scramble to adapt to fresh export restrictions from the Democratic Republic of Congo (DRC). The world’s largest cobalt producer has tightened quotas on cobalt hydroxide, the critical feedstock for electric vehicle (EV) batteries, sending shockwaves through supply chains and triggering a rally in cobalt metal and sulfate […]

Gold Pushes into Record Territory amid U.S. Shutdown, Eyes on Rate Cuts

Gold is once again proving why it remains the world’s premier safe-haven asset. As of early October 2025, the yellow metal is trading above US$3,850 per ounce, pushing toward new record highs amid mounting macroeconomic uncertainty. A combination of the ongoing U.S. government shutdown and rising expectations that the Federal Reserve may soon pivot to […]

Ivory Coast Grants 11 New Exploration Permits, Boosting Gold & Cobalt Frontiers

Global investors are keeping a close eye on Africa’s resource frontiers as the Ivory Coast, one of West Africa’s most promising jurisdictions, takes another bold step to attract mining capital. On October 2, 2025, the government announced it has granted 11 new mining exploration permits, covering gold, cobalt, and copper blocks across the country. The […]

Mosaic Sees Earnings Tailwinds from Fertilizer Strength and Potash Price Rebound

Global fertilizer markets are once again commanding investor attention, as shifting agricultural demand, tightening supply chains, and policy signals converge to support higher pricing. Among industry leaders, Mosaic Company (NYSE: MOS) is standing out: according to recent commentary from Zacks, the fertilizer giant is benefiting from a potent mix of robust market demand, improving potash […]

Guanajuato Silver Launches $31M Financing to Support Operations Amid Retreating Share Price

The silver market has been one of the strongest performers in the precious metals sector this year, with industrial demand for solar panels and electronics complementing its traditional role as a safe-haven asset. But for junior miners, raising capital remains a challenge. This week, Guanajuato Silver (TSXV: GSVR) announced it is launching a C$43 million […]

U.S. Government Takes 5% Equity Stake in Lithium Americas, Fueling Stock Rally

Global energy markets are undergoing a structural shift, and lithium is at the center of it. In a move that signals the U.S. government’s heightened urgency to secure critical minerals, the Department of Energy (DOE) announced this week it will acquire a 5% equity stake in Lithium Americas (NYSE: LAC; TSX: LAC) and another 5% […]

Indonesia’s Nickel Ore Imports Surge Amid Smelter Expansion – and Glencore Eyes BHP’s WA Assets

Global nickel markets are in flux as two pivotal developments emerge: Indonesia is importing more nickel ore than ever to feed its aggressive smelter expansion, and in Australia, BHP’s Western Australian nickel assets are drawing the attention of Glencore and private equity investors. Together, these moves highlight a shifting landscape in global nickel supply chains […]

MOIL Ltd Implements Price Changes for Manganese Ore Products Effective October 1, 2025

India’s manganese market is witnessing a strategic shift as MOIL Ltd, the nation’s leading manganese ore producer, announces adjustments to its product pricing effective October 1, 2025. Investors and industry watchers are taking note, as these moves could influence revenue streams, market positioning, and broader commodity trends in the battery and steel sectors. Strategic Price […]

Gold Breaks Record as Safe-Haven Demand Surges Amid U.S. Shutdown and Rate Cut Bets

Gold surged to a fresh all-time high near US$3,895/oz on October 1, 2025, extending a historic rally that underscores investor anxiety over a fragile U.S. economy, fiscal dysfunction, and expectations of a Federal Reserve pivot toward lower interest rates. The move has positioned gold not only as a hedge against risk, but increasingly as a […]