DRC Replaces Cobalt Export Ban with Quota System Beginning October 16, 2025

Global markets are on edge as the Democratic Republic of Congo (DRC), which supplies over 70% of the world’s cobalt, prepares to overhaul its export system. On October 16, 2025, the country will end its controversial cobalt export ban and introduce quotas that cap outbound shipments well below historical levels. With cobalt being indispensable for […]

U.S. Defense Stockpile Moves to Secure Scandium Oxide from Rio Tinto

Global supply chains are once again in the spotlight as the United States takes decisive steps to fortify access to critical minerals. The U.S. Defense Logistics Agency (DLA) has confirmed plans to purchase up to US$40 million worth of scandium oxide from Rio Tinto over the next five years, a move designed to strengthen the […]

Central Bank Moves and China’s Inventory Signals May Shift Base Metals Prices — Aluminium Could Go From Surplus Toward Deficit

Global markets are entering a new phase of uncertainty and opportunity as central banks pivot toward more accommodative monetary policy while China signals tightening in its aluminium sector. For investors watching the commodities space, these shifts could mark a turning point in the base metals cycle — especially in aluminium, where supply dynamics appear to […]

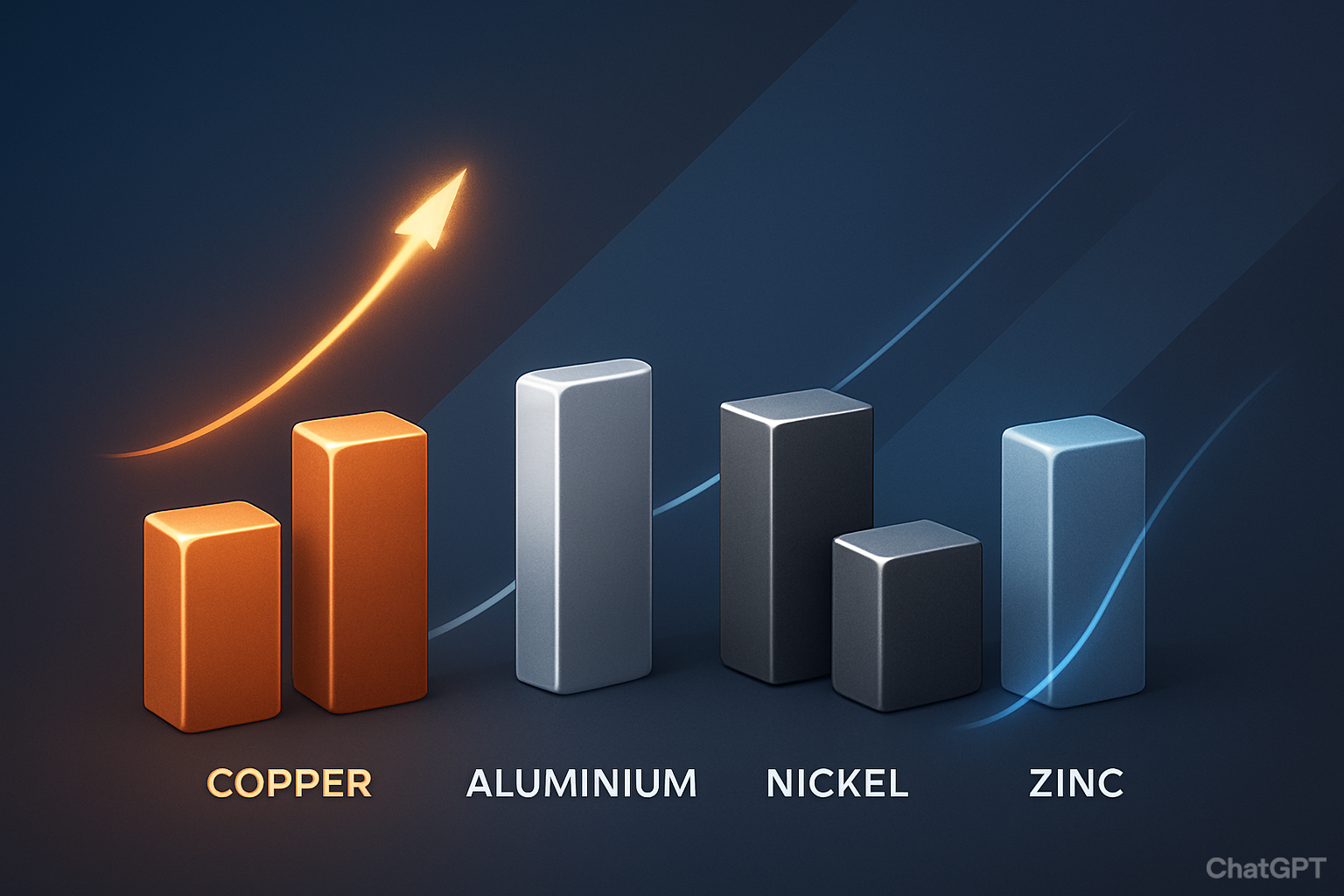

UBS Raises Copper & Aluminium Forecasts, Cuts Nickel; Zinc Outlook Mixed

Global investors are increasingly looking to base metals as bellwethers of industrial growth, electrification, and energy transition. This week, UBS released its updated forecasts for key metals, highlighting bullish momentum in copper and aluminium while striking a more cautious tone on nickel and zinc. The revisions come at a time when commodity markets are grappling […]

Nutrien Reports Record Potash Sales Amid Strong Global Demand

Nutrien, the world’s largest potash producer, has recently announced record potash sales and raised its 2025 volume guidance, highlighting the strength of global demand and favorable market dynamics. This surge comes as investors closely monitor the fertilizer sector, recognizing the crucial role of potash in global agriculture and food security. Rising Demand Fuels Market Optimism […]

Anglo-Teck Merger Could Create A Copper Giant And Unlock Major Synergies in Chile

The global copper market, already bracing for persistent supply deficits amid soaring demand from electrification and infrastructure, was jolted this week by news that Anglo American and Teck Resources are preparing to merge in a deal valued at US$50–53 billion. The transaction would create one of the world’s largest copper producers, with combined assets in […]

Orion Minerals Strikes Deal with Glencore for $200–250M Funding to Kick-Off Copper-Zinc Project in South Africa

The global race to secure critical metals is intensifying, and a new partnership between Australia’s Orion Minerals and commodities giant Glencore is set to reshape the copper and zinc landscape. With both metals in high demand amid supply constraints and energy transition pressures, Orion’s agreement for up to US$250 million in funding marks a pivotal […]

China’s Steel Exports to Reach Record High, Prompting Global Pushback

Global markets are once again focused on China—not for its slowing property sector or monetary policy pivots, but for the surge in its steel exports. According to Reuters (Sept 16, 2025), China’s steel shipments are set to grow 4–9% this year, reaching a potential 115–120 million metric tons, a record not seen in nearly a […]

BHP Flags Organic Copper Growth and Eyes U.S. Attractive Costs; Silent on Big Buyouts

Copper has been one of the most closely watched commodities in 2025, with prices hitting multi-month highs on the back of supply disruptions and strong energy transition demand. Against this backdrop, BHP, the world’s largest miner, is signaling a strategic shift: it wants to grow its copper output organically rather than through high-priced acquisitions — […]

Freeport’s Grasberg Suspension Tightens Copper Supply; Prices Push to Six-Month Highs

Copper markets are once again in the spotlight as a confluence of supply disruptions and macroeconomic shifts drive prices to multi-month highs. Freeport-McMoRan’s announcement that its Grasberg mine in Indonesia will remain suspended following a crisis involving missing workers has sent ripples across the global metals market. The suspension of one of the world’s largest […]