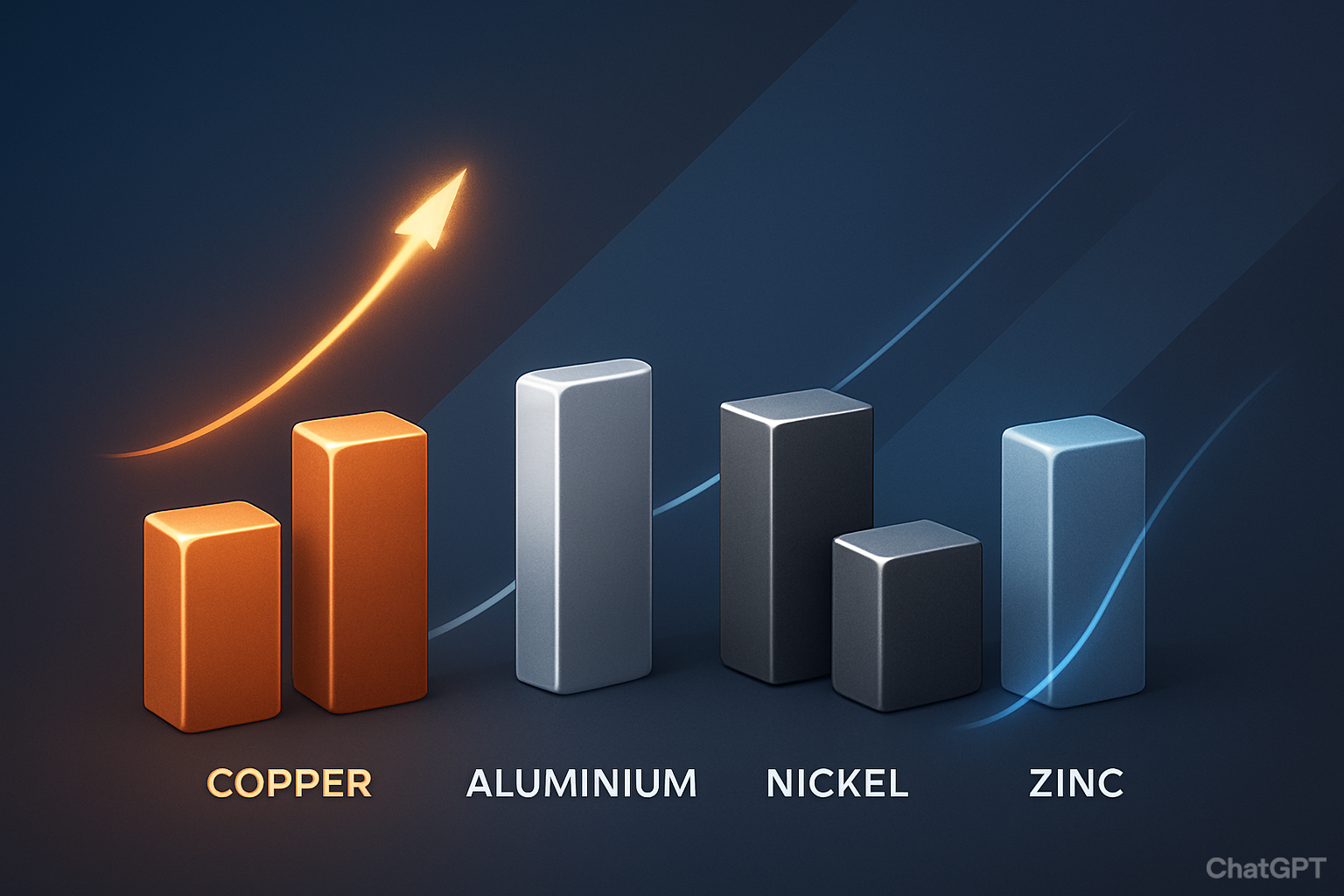

Global investors are increasingly looking to base metals as bellwethers of industrial growth, electrification, and energy transition. This week, UBS released its updated forecasts for key metals, highlighting bullish momentum in copper and aluminium while striking a more cautious tone on nickel and zinc. The revisions come at a time when commodity markets are grappling with shifting supply-demand balances, geopolitical bottlenecks, and heightened interest from governments seeking to secure critical mineral supply chains.

Copper and Aluminium: Strength in Supply Constraints

UBS lifted its copper price outlook to an average of $4.37/lb in 2025 and $4.80/lb in 2026, citing persistent supply-side challenges and resilient demand. A combination of declining ore grades, project delays, and underinvestment has limited new capacity coming online. At the same time, structural demand from grid expansion, electric vehicles, and renewable energy infrastructure continues to tighten the market.

Aluminium forecasts were also raised, underpinned by increasing demand from lightweighting in transportation, renewable power infrastructure, and packaging. While aluminium smelting remains energy-intensive, decarbonization initiatives are driving investment into lower-carbon production capacity, further tightening the supply picture.

According to UBS analysts, these conditions point toward strengthening prices through the medium term, making copper and aluminium some of the most strategically positioned metals in the broader base metals complex.

Nickel: Oversupply Remains a Drag

In contrast, nickel’s outlook has been revised downward. UBS lowered its forecasts for the next two years, reflecting an ongoing oversupply from Indonesia and weaker-than-expected demand from the stainless steel and battery sectors. Nickel prices have struggled to recover from recent declines, with inventory levels remaining elevated.

The battery sector—once seen as a game-changer for nickel demand—has faced slower adoption of high-nickel chemistries due to cost considerations and the rapid scale-up of lithium-iron-phosphate (LFP) technologies. This structural shift is limiting upside potential for nickel in the near term.

For investors, the message is clear: while nickel remains an important long-term energy transition metal, selectivity is key. Companies with exposure to high-cost operations may face margin pressure, while those with lower-cost supply or diversified revenue streams are better positioned to weather volatility.

Zinc: A Mixed Bag

UBS offered a more nuanced perspective on zinc, noting modest upward revisions but cautioning against assuming sustained strength. Zinc demand continues to hinge on construction and galvanization trends, both of which are highly cyclical. While supply disruptions could provide temporary price support, the broader fundamentals suggest volatility rather than a clear bullish trend.

Zinc investors should prepare for a bumpy ride, with potential upside only if mine closures or unexpected disruptions tighten the market more than expected.

Why This Matters for Investors

These forecast revisions highlight an emerging divergence within the base metals sector. Copper and aluminium are increasingly seen as structural winners in a decarbonizing world, with strong policy and industrial demand tailwinds. Meanwhile, nickel and zinc face more complex dynamics, including supply gluts, demand uncertainty, and cyclical risks.

Such differences underscore the importance of a targeted investment strategy. Broad exposure to base metals may not deliver optimal returns; instead, investors should consider differentiated approaches that overweight copper and aluminium while being cautious on nickel and zinc until clearer demand signals emerge.

Future Trends to Watch

- Policy Support: The U.S. and EU have moved to classify copper and potash as critical minerals, potentially accelerating permitting and financing support. Similar policies could favor copper and aluminium producers.

- Geopolitical Supply Risks: Concentration of nickel supply in Indonesia and copper supply in politically sensitive jurisdictions (e.g., Peru, DRC) remains a key variable.

- Technology Shifts: The battery industry’s chemistry evolution will continue to influence nickel demand. Likewise, innovations in aluminium smelting and recycling could reshape cost structures and margins.

Key Investment Insight

Investors may find the most compelling opportunities in copper and aluminium producers with low-cost, scalable operations and exposure to energy transition demand. Conversely, nickel and zinc investments should be approached selectively, focusing on companies with strong balance sheets, diversified asset portfolios, or integration into downstream markets.

Staying ahead of these shifting forecasts is essential as commodity markets remain volatile yet strategically critical to global economic transformation.

For daily updates and deeper insights into the trends shaping commodities and mining, stay connected with explorationstocks.com—your trusted source for investor news.